It’s important to understand the VA benefits available to you before you separate or retire from military service. While there are a variety of benefits available to veterans, there are a few critical ones you have to make decisions on towards the end of your service. Ignoring these or making the wrong choice could cost you down the road or force you to leave a ton of money on the table when you exit. Here are 3 big benefits that veterans tend to make consequential mistakes on:

Post-9/11 GI Bill. If there is any chance you aren’t going to use the Post-9/11 GI Bill for your own education, then make sure you transfer this entitlement to your immediate eligible family members (spouse and children). You can only do this while you are still in uniform and it will come with an additional service obligation of 4 years. This represents a free college degree that could otherwise cost $100,000 (or more) if you fail to do this ahead of time.

VA Life Insurance. Familiarize yourself with the VA life insurance benefits available to you at separation and compare those with private insurance plans. Your $400,000 of Servicemembers’ Group Life Insurance (SGLI) coverage ends 120 days after you separate. You can replace SGLI with Veterans Group Life Insurance (VGLI), and if you are retiring, you can sign up for the Survivor Benefit Plan (SBP) which passes on 55 percent of your pension to your surviving spouse or eligible beneficiaries (spouse concurrence is required for SBP if you choose to decline this benefit, so make sure you discuss this together ahead of time). These programs are great for some, but not for everyone. If you are healthy, you can find a cheaper policy with a higher payout from a private insurer. Look into private life insurance WELL BEFORE you start file a VA disability claim. If you get this backwards, you could find yourself uninsurable, or your premiums will be so high that VGLI and SBP rates will start to look like a bargain.

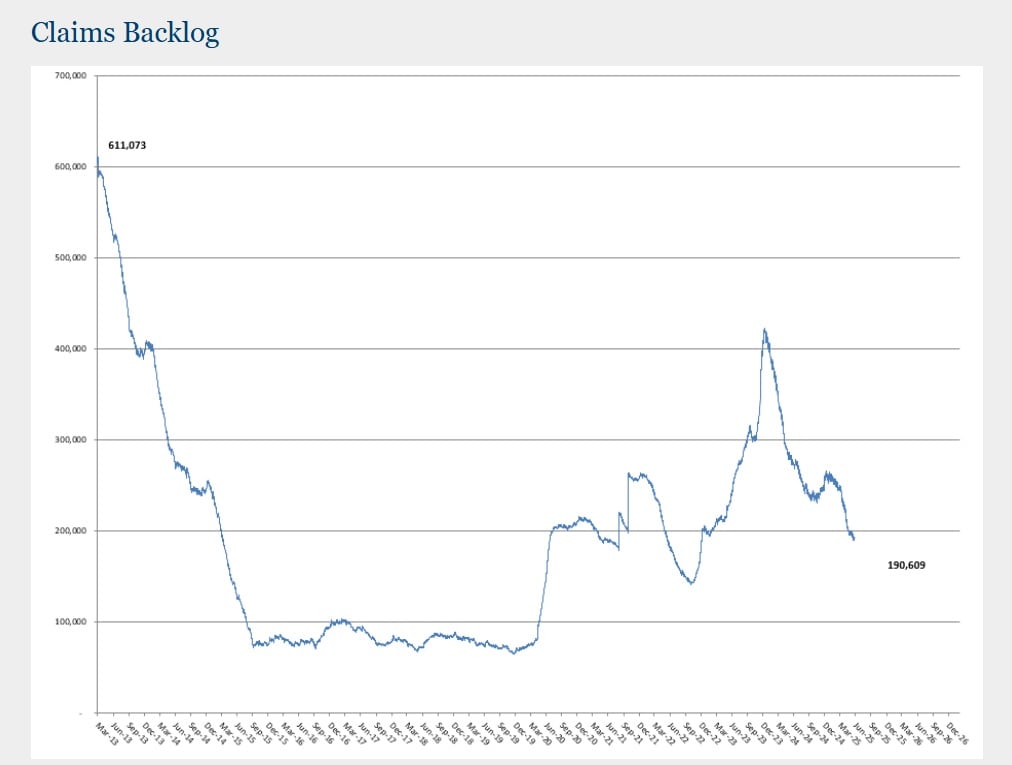

VA Disability Claim. No one is going to make you file a claim with the VA, but I highly recommend you take the time to do this. It’s important to get any service connected health issues and injuries thoroughly documented while you are still in uniform, otherwise this could be an uphill battle once you are off the roles. Ensure your medical records are complete and accurate, then when you are 6 months from separation (no earlier), give a copy of your records to an accredited Veteran Service Organization (VSO) to represent you and assist with navigating the VA claim process (they do this as a free service). The VA will determine your disability rating after your separation, which could take a few weeks or months. Never count on getting a VA disability check for income until after you get a rating.

In addition to taking care of the benefits above while you are still serving, here are some key limited enrollment windows for veterans benefits AFTER you take off the uniform for the last time:

(R=Retirement, S=Separation)

R+90 Days: enroll in a TRICARE plan within 90 days after your retirement, otherwise you have to go through the process of requesting a retroactive enrollment. Make this a day-1 task when you are off the roles. R/S+120: SGLI coverage ($400K) ends 120 days after separation. If you want to replace it with private insurance, do it WELL in advance of dropping a claim with the VA. R+240: if you sign up for VGLI within 240 days after retirement, you won’t need proof that you are in good health (no exam). R+575: VGLI enrollment window ends at 1 year and 120 days after retirement (+90 day Covid-19 extension). R+365: the gov’t will move your HHG within 1 yr after retirement before you need to apply for an annual extension with your Transportation Office (limit of 5 extensions). R+2-3 yrs: there is 1 opportunity to disenroll from SBP between 24-36 months after retirement. Otherwise, barring a few life-changing situations, SBP is a 30-year commitment. Understand the pros and cons of each and put these on your radar if you’re still making decisions on them.

Kirk Windmueller is a retired Green Beret and Army veteran with over 22 years of service. He is a senior manager at Avantus Federal and a volunteer for Project Transition USA, a non-profit organization that teaches veterans how to use LinkedIn to network and find their next career. He lives in Fayetteville, NC, with his wife and three kids.

If you have questions about how to transition out of the military, send them to us: transition@militarytimes.com