The decisions that 1.6 million service members are making this year about whether to stay with the old or jump to the new military retirement system have just one thing in common: Each decision is extremely personal.

So, as the deadline of Dec. 31 approaches for eligible service members to make the choice to opt in to the new Blended Retirement System, Military Times looked at how two service members approached their decisions. One of our volunteer participants chose the BRS, and one chose the legacy system. They both have about nine years of service. One is a Navy E-5, the other is an Air Force O-3.

If you’re in that group of people eligible to choose between the legacy system and the new BRS but haven’t made your decision yet, the thought processes of these two volunteers might help you start your research.

Those eligible to choose between the two retirement systems are active-duty troops with fewer than 12 years of service and reserve component members with fewer than 4,320 retirement points as of December 2017.

All troops entering the military now are automatically enrolled into the new BRS. Those with more than 12 years of service as of the end of 2017 automatically stay with the legacy system.

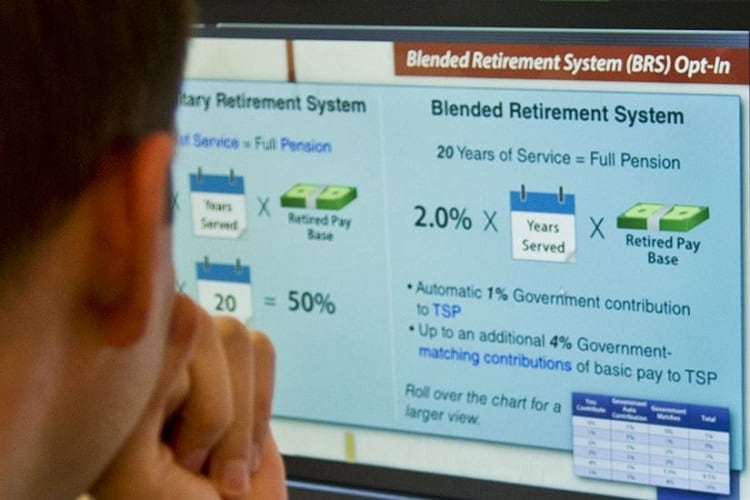

The BRS is a blend of the legacy retirement system and some new features. It still provides monthly retired pay after at least 20 years of service, but the pay is 20 percent less than under the current system.

Under the legacy system, if you leave before 20 years, you get nothing. Under BRS, you can receive matching contributions from DoD of up to 5 percent of your pay into your Thrift Savings Plan, and you can take that with you whether you leave after a few years or 20 years.

BRS also offers a one-time payout known as continuation pay at 12 years, with a commitment to serve an additional four years. And retirees can under BRS can opt for a partial lump-sum payout at retirement.

Both of our volunteers carefully considered all the pros and cons of both systems, but their own circumstances, career plans and perceptions led them to different decisions.

RELATED

We put our volunteers in touch with professional financial planners to discuss their current finances, the retirement decisions they’ve made, their goals, and whether there are any tweaks to their finances that could shore up that financial bridge to their retirement goals.

One notable thing these service members have in common: They’ve made great strides in paying off debt. That alone puts them in a better position for their goals.

Air Force Capt. Brad Byington and his former wife paid off $105,000 in consumer debt.

Navy Hospital Corpsman 2nd Class Ronald Rhea and his wife have paid off $45,000 in debt in the last year, since she started working after finishing school. They’re still working on their debt, but they’ve made great progress.

Rhea did his research early and jumped into the new BRS on Jan. 1, as soon as the enrollment window opened. He increased his contributions to his Thrift Savings Plan to 5 percent of his basic pay in order to get that full match from the Defense Department.

He didn’t realize that less than 20 percent of service members serve long enough to earn full retirement benefits. While he hopes his prospects are good, he said, he knows there’s no guarantee that he’ll serve to retirement.

For him, the 20-percent reduction in retirement pay if he does reach full retirement eligibility is worth the tradeoff because of the uncertainty.

Byington, who is single and 31, is putting away 15 percent in his Thrift Savings Plan account. Although he doesn’t get any DoD matching contribution by staying in the legacy system, he’s still on track to building his nest egg in addition to the legacy retirement benefits.

He believes his prospects are good for retiring from the Air Force, which is a key part of his decision. After crunching the numbers, with his continued 15 percent contributions and the assumption he retires after at least 20 years, he said, the matched BRS contributions of 5 percent still never accumulate enough to make up for what he would receive under the legacy system.

“There’s just absolutely no way for the new retirement system to pay out as much as the old,” he said.

Read their stories here:

RELATED

RELATED

Karen has covered military families, quality of life and consumer issues for Military Times for more than 30 years, and is co-author of a chapter on media coverage of military families in the book "A Battle Plan for Supporting Military Families." She previously worked for newspapers in Guam, Norfolk, Jacksonville, Fla., and Athens, Ga.